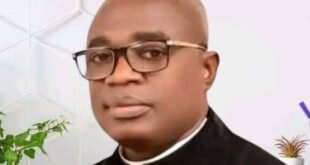

Senator Mukhail Adetokunbo Abiru

₦ 1,3 trillion of trillion lost against Ponzi: committees for orders of the Nigerian Senate to probe fraudulent patterns

By Raphael Ekpang

Abuja (basic reporter) annoyed by the recurring loss of money by the Nigerians with fraudulent patterns, the Nigerian Senate has promised to launch an investigative process in the operations of Ponzi’s patterns and unregulated investment platforms in Nigeria.

This is the sequel to a collapse of exchanges of crypto bullions, a fraudulent digital scheme that according to what has been reflected for unsuspecting Nigerian citizens of over 1.3 trillion.

The Sente Took This Step Following a Motion, Moved by Senator Mukhail Adetokunbo Abirir (Lagos East) and Co-Sponsored by Senator Osita Bonaventure Izunaso (IMO West) On Wednesday, July 9, 2025 Raised Alarm over the Unchecked Proliferation of Financial Frauds that continues to exploit poor and vulnerable nigerians under the mask of investment opportunities.

By presenting the motion on the Senate’s floor, Senator Abiru observed that the civic accident was part of an emerging tendency of Ponzi and online pyramid patterns that use technology, social media and even the celebrities to attract the Nigerians in investing in fraudulent fans who promise exhorting return.

“These platforms are increasingly sophisticated. They use reference commissions, false testimonies and marketing led by influencers to build confidence between the masses,” said Abiru. “Many Nigerians, including low -income students and earnings, have lost everything. Some have been pushed to depression, the collapse of the family and even suicide.”

He described the civic scandal as “one of the most devastating financial scams in the history of the country” and expressed shock of being able to operate in full public vision without any intervention from the key to the financial regulators of Nigeria, of the Central Bank of Nigeria (CBN), the Securities and Exchange Commission (sec), the Commission for economic and financial crimes (EFCC) and Nigeria and Nigeria (NFN).

Inhair stressed that while the Constitution authorizes the National Assembly to investigate issues that affect the national interest and the well -being of citizens, the regulatory agencies must be held responsible for not having protected the Nigerian public from this huge financial crime.

During the debate, most senators expressed indignation for the recurring nature of the Ponzi system collapsed in Nigeria, dating back to the notorious Mmm in 2016 and Forex MBA in 2020.

Senator Abdul Ningi (Bauchi Central) described the situation as a national tragedy and a failure of the government’s supervision. “The rural inhabitants, the women of the market, the craftsmen, the students, the people who struggle every day to survive, are the most affected. And all this happened under the nose of our regulators,” Ningi said.

He added that the extent of the losses suffered through number and other online patterns was not only a domestic embarrassment, but a threat to foreign direct investments in Nigeria. “How can a foreign investor trust in an economy where citizens losing close to $ 1 billion and nobody is sanctioned?” he asked.

Senator Sani Musa (Niger East) said that “some Nigerians not only lost money but have lost their heads and life. This is not only economic exploitation, it is a psychological war against the people”.

Senator Solomon Adeola (Ogun West) warned that Ponzi -style platforms are only a part of a wider wave of Fintech fraud and unregulated payment gateway that take root in Nigeria.

He urged the Senate to question the CBN on which digital guarantees and framework he established to supervise the financial technology platforms.

“We cannot afford this digital financial unconsciousness to continue. In no other serious country are these types of” investment miracles “authorized to hit uncontrolled,” said Adeola.

The president of the Senate Godswill Akpabio praised the sponsors of the motion and underlined the urgency to restore public trust and economic stability.

“This motion speaks to the soul of the nation. If it does not affect you directly, it affects your family, your friends, your components,” said Akpabio. “Many of these fraud date back to decades ago. The same cycle continues to repeat, people invest, the platforms collapse and there is no responsibility. This must end now.”

He also mentioned a personal experience of the past financial collapses in Nigeria, remembering how millions of naira were kept in the warehouses by scammers, only to rot, evidence, he said, both of the greed and the lack of application.

The Senate agreed that the committees must not only investigate the fraud, but also engage in zonal public auditions and educational campaigns to illuminate the Nigerians on the risks of online financial patterns and the importance of regulatory compliance.

The committees were commissioned to start working immediately and refer to the Senate in four weeks. Their results should guide future legislation and possibly lead to disciplinary actions or renovation of the roles of financial regulators.

Legislators stressed that “it is not just money. It concerns national security, public trust and our collective responsibility to protect every Nigerian from predators masked by investors”.

As a result, the Senate decided to impose his joint committees on the capital markets; Banking, insurance and other financial institutions; Anti -corruption and financial crimes; and tic and computer security to: conduct a global investigative hearing on the operations of the Ponzi schemes in Nigeria; He examines the regulatory gaps and falls that have allowed patterns such as the civic to thrive, recommend solid legislative and institutional reforms to prevent future events and launch a public awareness campaign at national level to educate the Nigerians on digital investment scams and financial literacy.

JamzNG Latest News, Gist, Entertainment in Nigeria

JamzNG Latest News, Gist, Entertainment in Nigeria